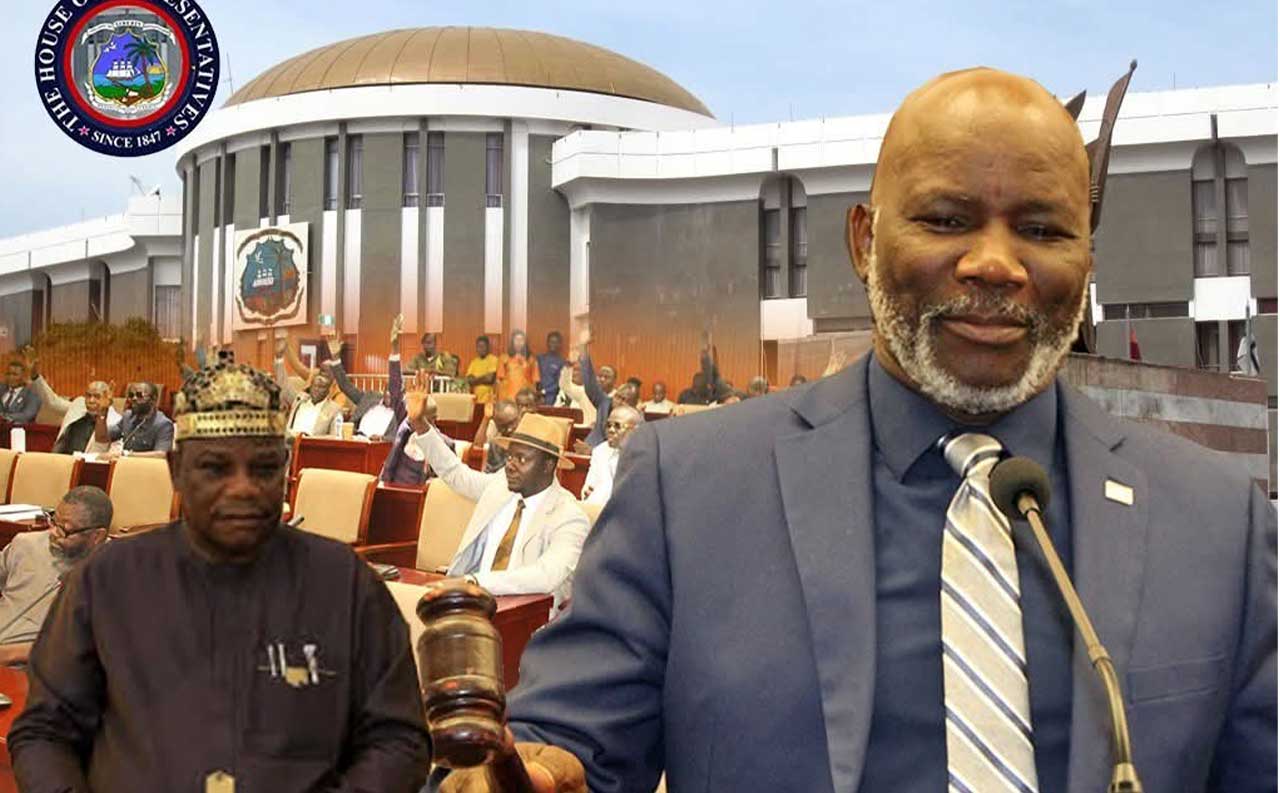

The Leadership of the Honorable House of Representatives held a constructive conversation with the Commissioner General of the Liberia Revenue Authority (LRA) Dorbor Jallah and his legal counsel, Cllr. Negbalee Warner on Tuesday, March 26, 2024.

According to a press release from House Bureau, the end of the discussion, the Commissioner General agreed with the Minister of Justice that the LRA had misinterpreted the law and apologized for disallowing the duty free privileges of lawmakers under the Revenue Code of 2000.

The Commissioner General then committed to following the law that has granted duty free privileges to lawmakers since the law was passed.

Duty free privileges allow lawmakers to be able to respond to charitable needs of their various constituents while they serve and will remain in place.

The Legislature has already capped duty free privileges to ensure that this vital allowance under the law isn’t abused and that LRA collects the maximum amount of taxes possible.

The House of Representatives is committed to promoting transparency and accountability at all levels and will do absolutely nothing to stop the collection of lawful Revenues for Liberia.

The Revenue Code of Liberia Act of 2000 which was amended in 2016 reserved the portion of Section 1708 granting Lawmakers duty free privileges for two vehicles annually.