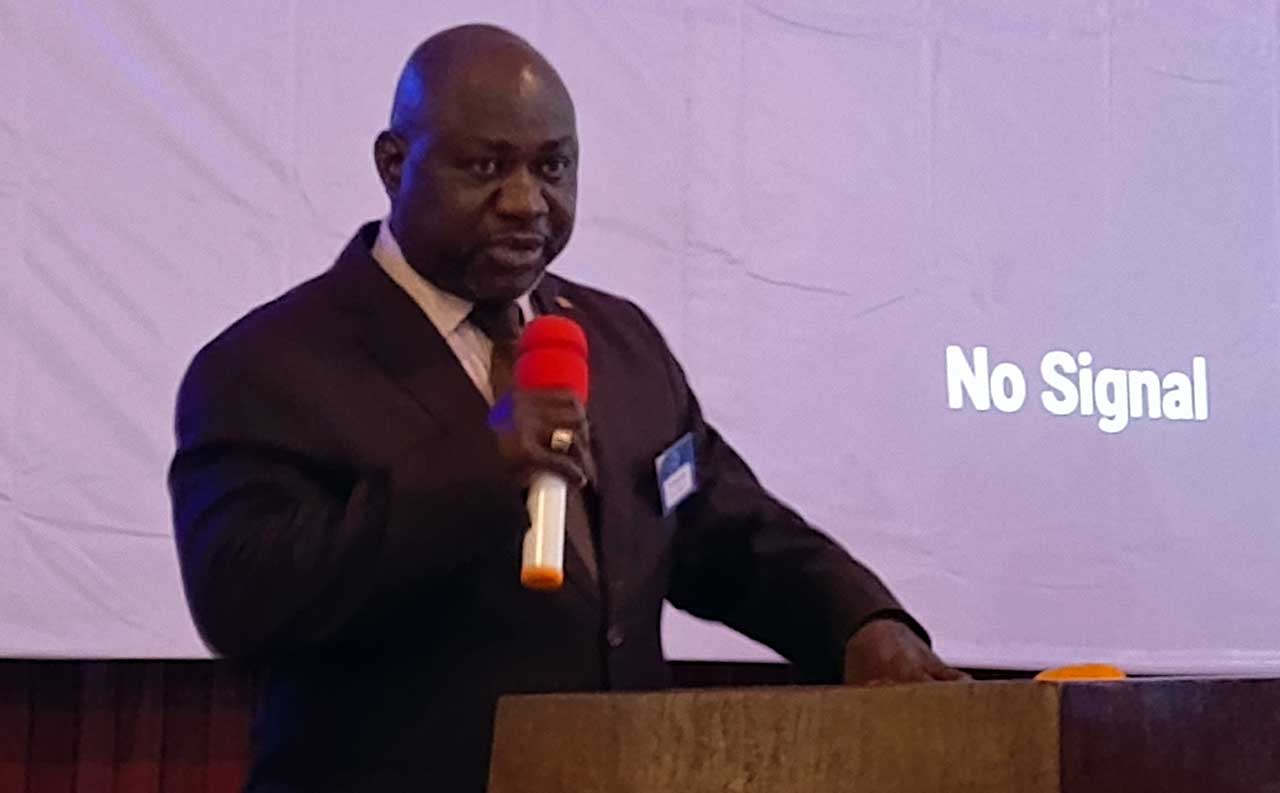

The Chairman of the Law Reform Commission (LRC), Cllr. Boakai kanneh, has underscored the importance of legislating the draft insurance law of 2020. Speaking on Wednesday, March 5, 2025, at the start of a three-day validation workshop to review the draft insurance law of 2020 at the Executive Pavilion in Monrovia, Cllr. Kanneh said, ‘‘I am very certain that there is no body in this room that will downplay the significant of insurance in the economy of any country.’’

For this reason, Cllr. Kanneh said the sector has to be legislated. ‘‘When I was approached as my involvement in this exercise, I immediately obliged that even though there are constraints. I obliged because consistent with the National Law Reform Policy it is required especially of a very significant legislation it is required that before it is put out before the Legislature and by extension the president there must be an exercise like this which is dubbed validation,’’ the LRC Boss told the gathering.

According to him, the validation is intended to give an opportunity to the stakeholders in the sector to make an input in the draft law that will allow the accessibility of the law. The renowned Liberian lawyer said it narrows down the competition on jurisdiction fight and oppose and that it makes provision for the efficient running of the institution. ‘‘It is for that purpose that we have embarked on the validation. This exercise ordinarily will require that the document be projected and we will go through it word for word because in law every paragraph is important,’’ Cllr. Kanneh said.

But he pointed out that given the voluminous nature of this document, they decided to compartmentalize it into sections where you will have presenters presenting on different sections and you will have feedback from the audience. ‘‘Thereafter, should you have comments, observations, the secretariat will be available so that they pick up those comments so that they can include them in the final write out. It is my anticipation that we will be very participatory and remain committed for the next three days so that we can go through this exercise,’’ the LRC head stated.

‘‘Remember that this is very important as we try to grow our economy insurance is one such sector that helps to do that. As it is now the sector is such a vulnerable area without a regulator that is the reason why the Law Reform Commission is to ensure that we write this law and eventually advance it to the presidency and by extension to the legislature to ensure that at for the end of the exercise we have a vibrant insurance commission for Liberia,’’ he added.

Meanwhile, the validation workshop is being attended by stakeholders with diverse expertise to enhance the validation of the Proposed Draft Insurance Commission Act.

Stakeholders’ feedback and recommendations will be incorporated into the final draft to be submitted to the Office of the President for onward submission to the National Legislature for passage.

Upon passage by the Legislature, the Insurance Commission Act will lead to the creation of the National Insurance Commission of Liberia.

Amongst other things, the draft Proposed Insurance Commission Act includes the framework for the issuance of regulating and supervising the Insurance Sector, licenses, enforcement of compliance, taking enforcement action against unlicensed firms, and establishing standards for conducting insurance business in Liberia.

Under the draft Act, the proposed Insurance Commission will have power to subpoena information and witnesses from various government entities, enforce mandatory insurances including third-party motor insurance, Fire Insurance,

Marine, Professional indemnity Insurance and create a department to handle complaints against insurers or insurance institutions. This new entity will be the sole regulator of the insurance industry, ensuring that license holders are supervised on a risk-sensitive basis, fostering competition within the industry and expanding access to the insurance market in Liberia. By fostering a well-regulated insurance sector, the commission will also contribute to the overall economic stability and growth of the country.

The Central Bank of Liberia is optimistic that the involvement of stakeholders in the validation process of the draft act will ensure due diligence and best practices as required for the passage of the act and subsequent establishment of the insurance commission.

The CBL also emphasizes that the engagement and contributions of stakeholders are vital to the successful validation of the Draft Insurance Act, which aims to create a transparent, efficient, and inclusive insurance industry in Liberia.